inheritance tax rate indiana

Federal estatetrust income tax return due by April 15 of the year following. Indiana doesnt have an inheritance or estate tax.

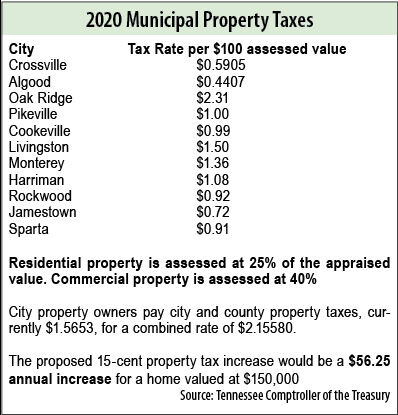

15 Cent Property Tax Increase Ok D Local News Crossville Chronicle Com

Although the State of Indiana did once impose an inheritance tax the tax was repealed for deaths that occurred after 2012.

. Indiana taxes capital gains at the same rate as other income 323. Anyone who gets more than that has to pay a tax rate of up to 40 percent on the excess. For example a lucky grandchild who inherits 150000 would owe tax on 50000 because for Class A beneficiaries no tax is due on the first 100000 inherited.

Iowa Inheritance Tax Rates Accessed Jan. For more information please join us for an upcoming FREE seminar. The Inheritance tax was repealed.

However be sure you remember to file the following. The current tax rate for class a beneficiaries is from 1 to 10. The appropriate tax rate.

Inheritance tax rate indiana. Indiana was the 42nd state to ratify some form of death transfer taxationThe first act was. The Iowa tax only applies to inheritances resulting from estates worth more than 25000.

Contact an Indianapolis Estate Planning Attorney. Tax rates can change from one year to the next. Keep reading for all the most recent estate and inheritance tax rates by state.

People who receive less than 112 million as part of an estate can exclude all of it from their taxes. The lowest rate is. Indiana Inheritance and Gift Tax.

Indiana House Ways and Means Committee Chairman Tim Brown R-Crawfordsville left talks with reporters alongside Senate Appropriations. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. Indiana had one but the state repealed it in 2013.

Property owned jointly between spouses is exempt from inheritance tax. Note that historical rates and tax laws may differ. A Guide to Kentucky Inheritance and Estate Taxes Page 1.

Sandra would be responsible for paying the tax. Kentucky Department of Revenue. Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there.

In 2021 the credit will be 90 and the tax phases out completely after December 31 2021. Below are the ranges of inheritance tax rates for each state in 2021 and 2022. If an estate is worth 15 million 36 million is taxed at 40 percent.

However other states inheritance laws may apply to you if someone. Maryland Office of the Register of Wills. While the tax rate has remained the same over the years.

31 2012 no inheritance tax has to be paid. The Indiana inheritance tax became effective on May 1 1913 after 10 years of spirited debate. While it typically gets a bad rap probate was added into Indiana inheritance laws to protect the last wishes of a decedent whether he or she had a testate will or not.

A federal estate tax ranging from 18 to 40. No tax has to be paid. Inheritance and Estate Tax.

States have typically thought of these taxes as a way to increase their revenues. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as estate taxes without the. INDIANAPOLIS AP Proposed cuts to Indianas individual income tax rates might not be automatic under methods legislative leaders discussed Monday.

Inheritance tax applies to assets after they are passed on to a persons heirs. The inheritance tax rate usually graduates depending upon the degree of kinship between the deceased and their beneficiary. Children of the deceased typically pay the lowest rate in states that.

45 percent on transfers to direct descendants and lineal heirs. However many states realize that citizens can avoid these taxes by simply moving to another state. The Probate Process In Indiana Inheritance Law.

Estate tax rates vary from state to state. Administration of Estates in Maryland Pages 1-2. Anyone who gets more than that has to pay a tax rate of up to 40 percent on the excess.

Tax rates can change from one year to the next. No estate tax or inheritance tax kentucky. Final individual federal and state income tax returns each due by tax day of the year following the individuals death.

No tax has to be paid. Indiana has a three class inheritance tax system and the exemptions and tax rates vary between classes based on the relationship of the recipient to the decedent. In Maryland the tax is only levied if the estates total value is more than 30000.

This number doubles to 224 million for married couples. There is no inheritance tax in Indiana either. As of 2020 only six states impose an inheritance tax.

The phase out of inheritance tax will commence in 2013 with a 10 credit being applied. There is also a tax called the inheritance tax. The decedents surviving spouse pays no inheritance tax due to an unlimited marital deduction.

15 percent on transfers to other heirs except charitable organizations exempt institutions and government entities exempt from tax. Indiana does not have an inheritance tax nor does it have a gift tax. The top inheritance tax rate is 16 percent exemption threshold for class c beneficiaries.

Indiana lawmakers discuss trigger for income tax cuts. For individuals dying after Dec. State inheritance tax rates.

The inheritance tax rates are Class A Net Taxable Value Of Property Interests Transferred Inheritance Tax 25000 or less 1 of net taxable value Over 25000 but not over 50000 250 plus 2 of net taxable value over 25000 Over 50000 but not over 200000 750 plus 3 of net taxable value over 50000. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed. Whereas the estate of the deceased is liable for the estate tax beneficiaries pay the inheritance tax.

Even though there is a state tax assessment there is no inheritance tax estate tax or gift tax. Substantially a copy of the New York statutes of 1911 but it was also similar to the statutes of. Each beneficiary except those who are entirely exempt from the tax must pay tax on the amount he or she inherited minus the exempt amount.

Maryland New Jersey Pennsylvania Kentucky Iowa and Nebraska have inheritance taxes as of 2022. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. Capital Gains Taxes.

There is no federal inheritance tax and only six states have a state-level tax. The indiana inheritance tax became effective on may 1 1913. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold.

Inheritance tax rate indiana.

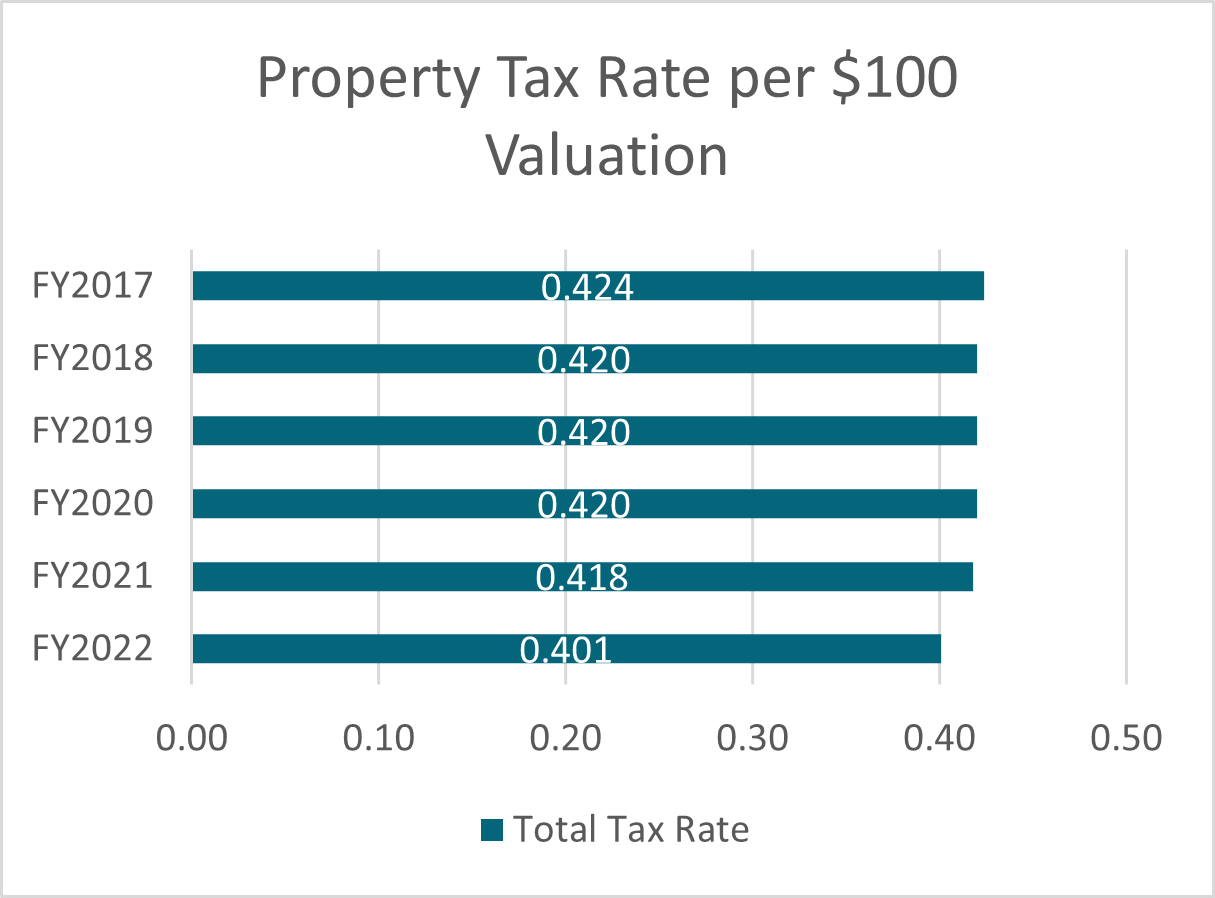

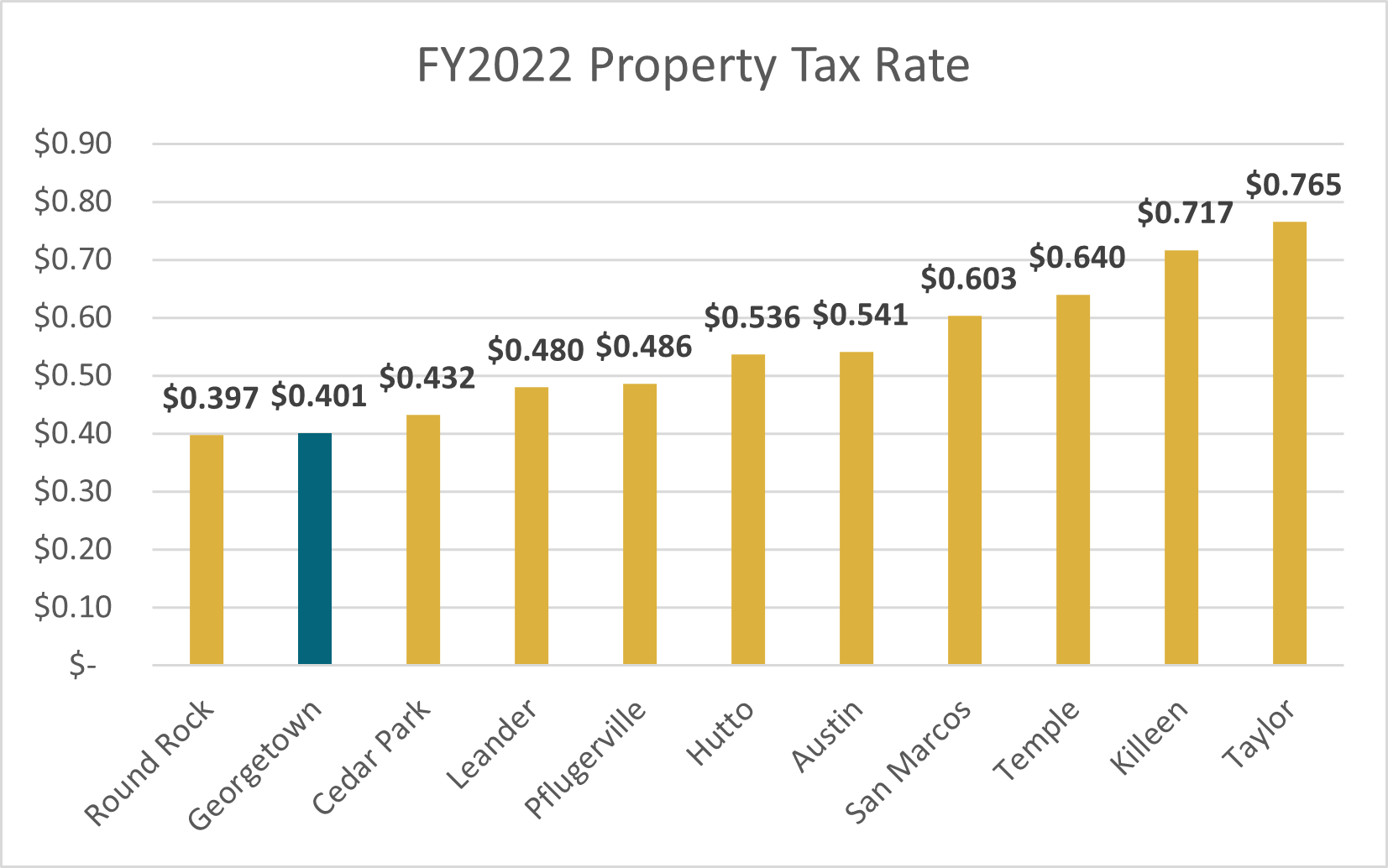

Property Taxes Georgetown Finance Department

Pennsylvania Property Tax H R Block

How Do State And Local Sales Taxes Work Tax Policy Center

How To Reduce Virginia Income Tax

Personal Income Tax An Overview Sciencedirect Topics

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

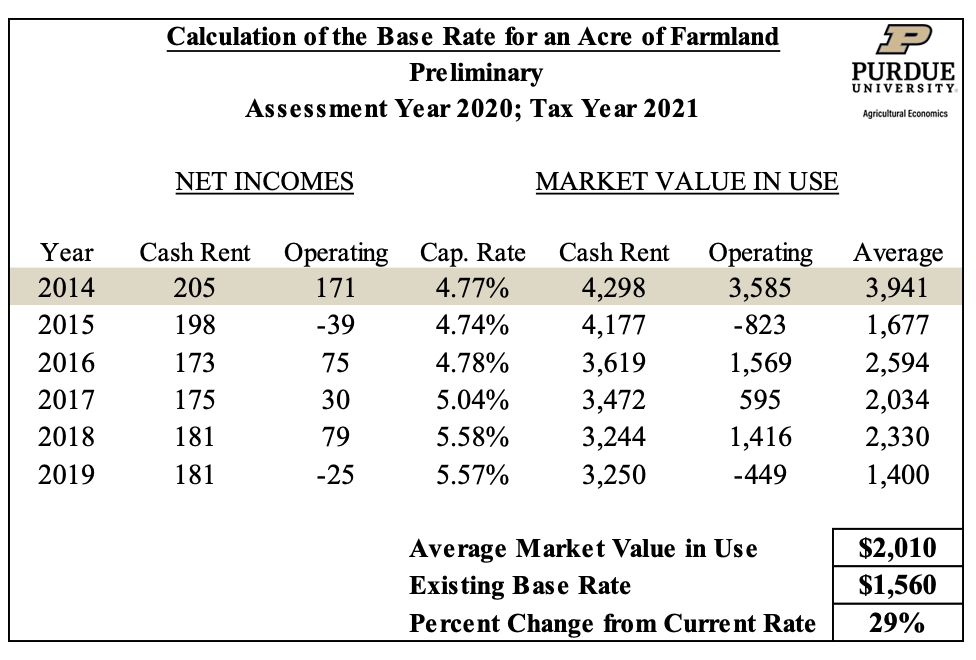

Farmland Assessments Tax Bills Purdue Agricultural Economics

Indiana Estate Tax Everything You Need To Know Smartasset

Indiana Estate Tax Everything You Need To Know Smartasset

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Property Taxes Georgetown Finance Department

States With Highest And Lowest Sales Tax Rates

States With No Estate Tax Or Inheritance Tax Plan Where You Die

New Tax Data News Release Archive City Of Carmel

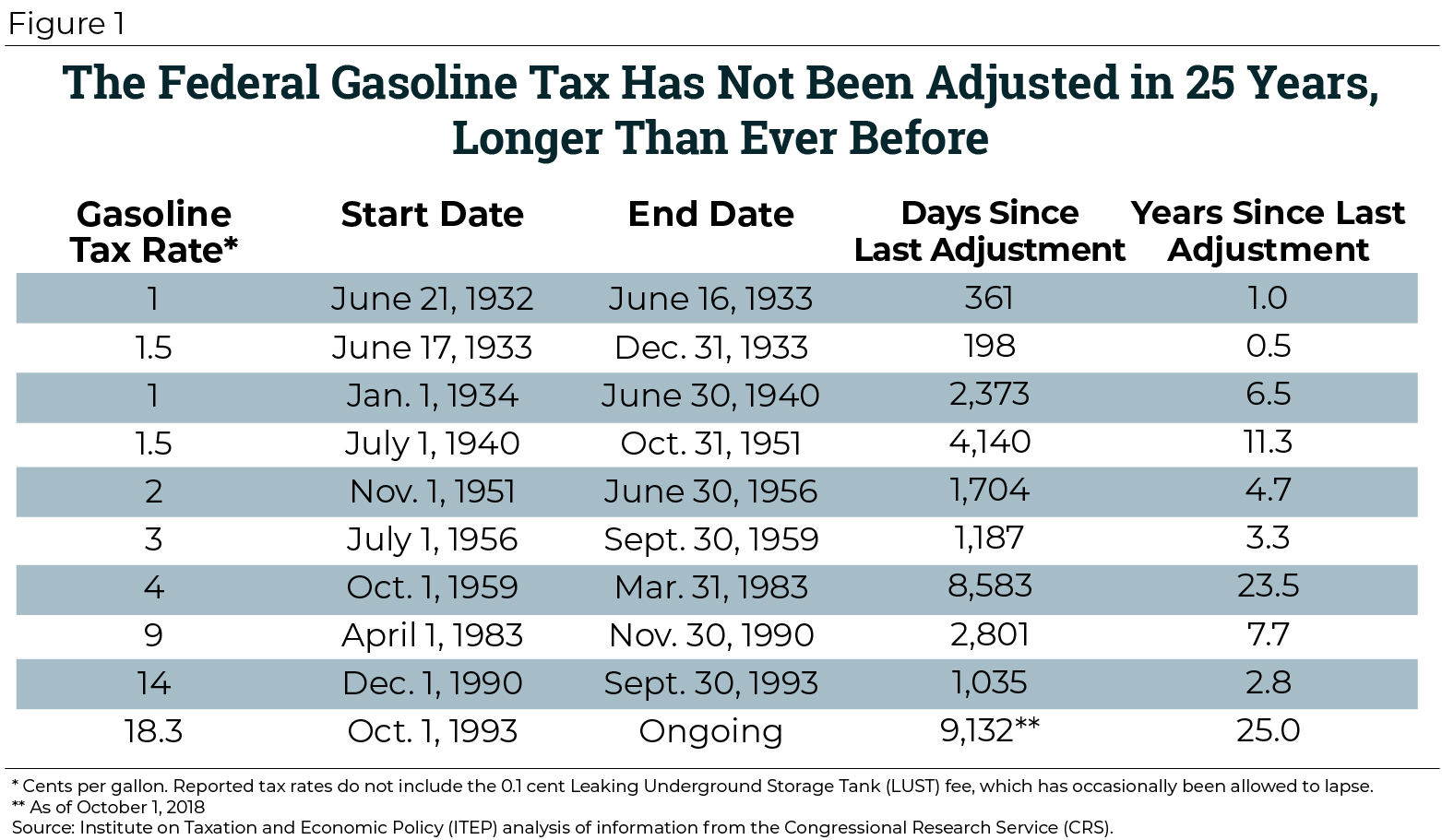

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep